Welcome to My Smart Finance – Where Financial Wisdom Meets Smart Decisions.

Your journey to smarter savings, investments, and financial freedom starts here.

Emnify Launches Consumer eSIM Solution to

At My Smart Finance,

Naturally Intelligent

From budgeting to investing – My Smart Finance is your trusted guide to financial confidence.

My Smart Finance helps you make informed choices.

LATEST

10 Influencer Scams To Avoid If…

Have you ever scrolled through social media and thought, Wow, this person is making six figures a month, how do I get in on that? Same. Social media is flooded with people claiming they’ve cracked the code to overnight success, passive income, or early retirement. But here’s the truth: many of these so-called experts are

Sleepless in Kyiv: how Ukraine's capital…

Sleepless in Kyiv: how Ukraine's capital copes with Russia's nighttime attacks

How To Compute Your Product Price…

Isa sa pinaka-importanteng tanong ng bawat aspiring negosyante ay: “Paano ko iko-compute ang presyo ng produkto o serbisyo ko?” Madaling sabihin na dapat “may tubo” – pero paano nga ba ito gawin nang tama? Here’s a simplified step-by-step guide to help you set the right price for your product or service: 1. Alamin ang Total

Next Level

- Your Retirement Withdrawal Order of Operations

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Retirement withdrawal strategies are one of the most common topics that you readers write to me about. You ask questions like: Which accounts and which assets should you withdraw first, and why? How does Social Security fit in? What … Read more

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Retirement withdrawal strategies are one of the most common topics that you readers write to me about. You ask questions like: Which accounts and which assets should you withdraw first, and why? How does Social Security fit in? What … Read more - You don’t have to be afraid…

Advertiser Disclosure: rich & REGULAR is a member of affiliate marketing programs and may receive commission in exchange for promoting products and services. I [Julien] hate hotel gift shops. Every time I set foot in one, I can feel the insane price premium squeezing money out of me. One time, while visiting Florida, I’d completely forgotten to … Read more

Advertiser Disclosure: rich & REGULAR is a member of affiliate marketing programs and may receive commission in exchange for promoting products and services. I [Julien] hate hotel gift shops. Every time I set foot in one, I can feel the insane price premium squeezing money out of me. One time, while visiting Florida, I’d completely forgotten to … Read more - Why Your Company May Be Struggling…

When it comes to the big world of business, times get hard. Not everything is going to go your way all of the time, and you’ve got to learn to be okay with that. Well, not okay with it per se, but you have to find ways to get through and make your business thrive … Read more

When it comes to the big world of business, times get hard. Not everything is going to go your way all of the time, and you’ve got to learn to be okay with that. Well, not okay with it per se, but you have to find ways to get through and make your business thrive … Read more - Why You Should Wake Up Early…

Since summer last year, I decided that I should wake up early. I read all the blogs about people who woke up early, and it just made sense to try it. All blogs stated that waking up early, meditating, affirmations, would all help you. They made it sound as if my life would magically change … Read more

Since summer last year, I decided that I should wake up early. I read all the blogs about people who woke up early, and it just made sense to try it. All blogs stated that waking up early, meditating, affirmations, would all help you. They made it sound as if my life would magically change … Read more - Why U.S. Life Insurers Are Moving…

Between 2019 and 2024, a monumental financial transformation has quietly unfolded within the U.S. life insurance sector: approximately $800 billion in reserves have been shifted offshore. This staggering figure not only marks one of the largest capital reallocations in recent industry history but also signals a significant evolution in how insurers manage risk, capital, and … Read more

Between 2019 and 2024, a monumental financial transformation has quietly unfolded within the U.S. life insurance sector: approximately $800 billion in reserves have been shifted offshore. This staggering figure not only marks one of the largest capital reallocations in recent industry history but also signals a significant evolution in how insurers manage risk, capital, and … Read more

Just Dropped

5 Things To Do If You’re…

This article is created in partnership with Squarespace. Starting a start-up is anything but simple. From the moment you get a great idea (inception) to the moment it’s up and running (completion) there are a lot of steps along the way. But that doesn’t mean every step has to be hard. Recently, Gracie J, lead

7 Frugal Meal Planning Ideas to…

Budgeting for groceries can be a challenge, especially when you’re trying to provide healthy frugal meal planning ideas for your family. Whether you’re a busy family, working professional, student, or a stay-at-home mom, meal planning can be a fantastic way to save money, reduce food waste, and ensure your family eats healthy, home-cooked meals. Here

Holiday Shopping on a Budget: Tips…

Okay, let’s talk about how to survive the holiday season and more specifically holiday shopping without completely draining your bank account. We’ve all been there – the pressure to buy gifts for everyone, the temptation of holiday sales, and the fear of overspending(especially with higher and higher prices). But fear not, my friend! With a

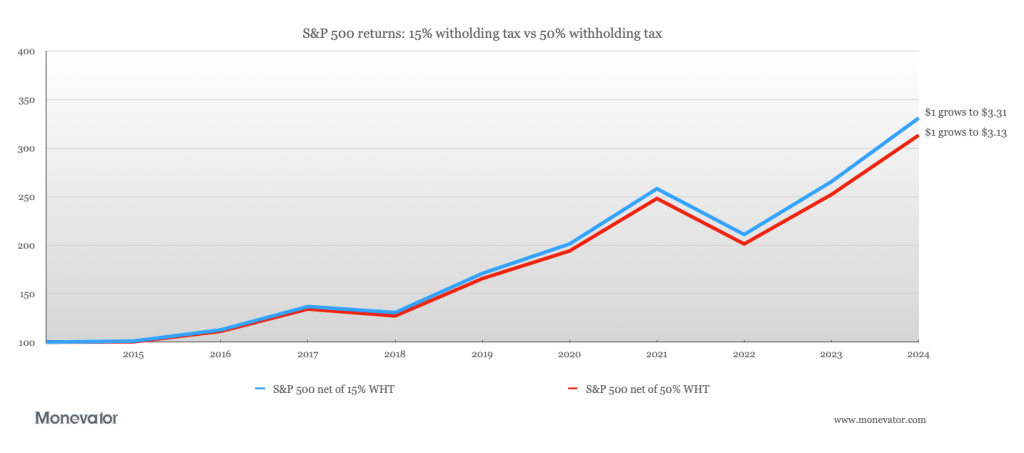

Trump’s ‘revenge tax’ and what it…

Oh god, what now? What now is Section 899 of the One Big Beautiful Bill – Trump’s monster-truck ‘tax and spend’ act currently bouncing around the halls of Congress. Section 899 has been dubbed a ‘revenge tax’ because it targets individuals, corporations, and governments of foreign countries who are deemed to be hitting US entities

Retail and hospitality jobs plummet following…

Jobs in the UK’s retail and hospitality sectors have declined at their fastest rate in recent history following Chancellor Rachel Reeves’s October budget, which increased employer National Insurance Contributions (NICs) by £25 billion. According to analysis of HMRC payroll data by The Times, employment in supermarkets, pubs, bars, and hotels has contracted sharply since the

How to Put Together a Benefits…

(This page may contain affiliate links and we may earn fees from qualifying purchases at no additional cost to you. See our Disclosure for more info.) You’ve finally decided to be your own boss. You won’t miss your overbearing manager, endless meetings that should have been emails, or white-knuckled commute. But you certainly will

9 Questions You’re Not Legally Required…

Highway Traffic Patrol Car in Pursuit of Criminal Vehicle, Speeding up the Road. Police Officers Chasing Suspect on Road, Sirens Blazing, Dust Flying. Stylish Cinematic Shot of Energetic Action Scene When those flashing lights appear in your rearview mirror or a police officer stops you on the street, nerves can kick in fast. But even

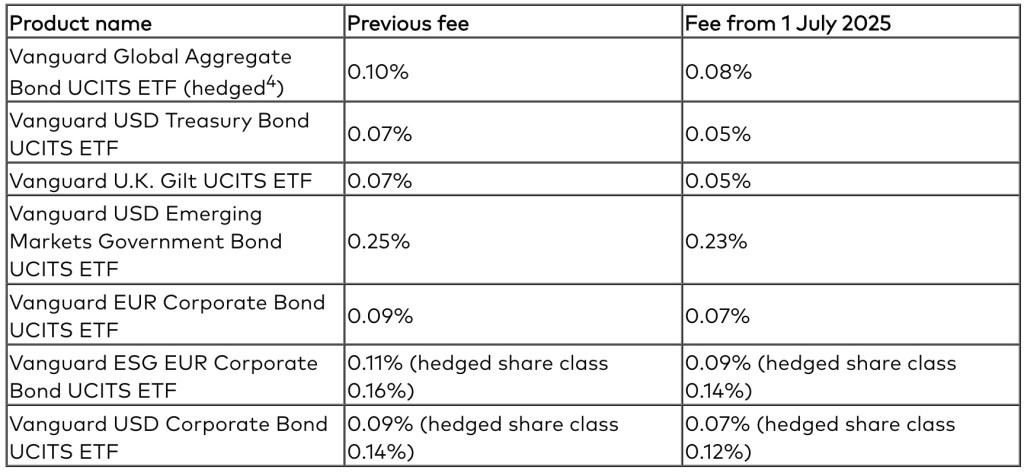

Weekend reading: Cheaper bond funds, for…

What caught my eye this week. Vanguard cut the fees on seven of its bond ETFs this week. For the full list see the table below. I got a heads-up on this fee-flailing from a thoughtful Monevator reader. They speculated that perhaps the price cuts were needed to gee up enthusiasm for bonds after the

47 Best Ways to Do It…

What would an extra $1,000 per month mean to you? For many people, it could: Cover your rent (or part of it) Allow you to leave a job and stay home with your kids Help you to pay off student loans, credit cards, or other debt Allow you to build up your savings Making an