Welcome to My Smart Finance – Where Financial Wisdom Meets Smart Decisions.

Your journey to smarter savings, investments, and financial freedom starts here.

Emnify Launches Consumer eSIM Solution to

At My Smart Finance,

Naturally Intelligent

From budgeting to investing – My Smart Finance is your trusted guide to financial confidence.

My Smart Finance helps you make informed choices.

LATEST

10 Influencer Scams To Avoid If…

Have you ever scrolled through social media and thought, Wow, this person is making six figures a month, how do I get in on that? Same. Social media is flooded with people claiming they’ve cracked the code to overnight success, passive income, or early retirement. But here’s the truth: many of these so-called experts are

Sleepless in Kyiv: how Ukraine's capital…

Sleepless in Kyiv: how Ukraine's capital copes with Russia's nighttime attacks

How To Compute Your Product Price…

Isa sa pinaka-importanteng tanong ng bawat aspiring negosyante ay: “Paano ko iko-compute ang presyo ng produkto o serbisyo ko?” Madaling sabihin na dapat “may tubo” – pero paano nga ba ito gawin nang tama? Here’s a simplified step-by-step guide to help you set the right price for your product or service: 1. Alamin ang Total

Next Level

- Your Retirement Withdrawal Order of Operations

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Retirement withdrawal strategies are one of the most common topics that you readers write to me about. You ask questions like: Which accounts and which assets should you withdraw first, and why? How does Social Security fit in? What … Read more

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Retirement withdrawal strategies are one of the most common topics that you readers write to me about. You ask questions like: Which accounts and which assets should you withdraw first, and why? How does Social Security fit in? What … Read more - You don’t have to be afraid…

Advertiser Disclosure: rich & REGULAR is a member of affiliate marketing programs and may receive commission in exchange for promoting products and services. I [Julien] hate hotel gift shops. Every time I set foot in one, I can feel the insane price premium squeezing money out of me. One time, while visiting Florida, I’d completely forgotten to … Read more

Advertiser Disclosure: rich & REGULAR is a member of affiliate marketing programs and may receive commission in exchange for promoting products and services. I [Julien] hate hotel gift shops. Every time I set foot in one, I can feel the insane price premium squeezing money out of me. One time, while visiting Florida, I’d completely forgotten to … Read more - Why Your Company May Be Struggling…

When it comes to the big world of business, times get hard. Not everything is going to go your way all of the time, and you’ve got to learn to be okay with that. Well, not okay with it per se, but you have to find ways to get through and make your business thrive … Read more

When it comes to the big world of business, times get hard. Not everything is going to go your way all of the time, and you’ve got to learn to be okay with that. Well, not okay with it per se, but you have to find ways to get through and make your business thrive … Read more - Why You Should Wake Up Early…

Since summer last year, I decided that I should wake up early. I read all the blogs about people who woke up early, and it just made sense to try it. All blogs stated that waking up early, meditating, affirmations, would all help you. They made it sound as if my life would magically change … Read more

Since summer last year, I decided that I should wake up early. I read all the blogs about people who woke up early, and it just made sense to try it. All blogs stated that waking up early, meditating, affirmations, would all help you. They made it sound as if my life would magically change … Read more - Why U.S. Life Insurers Are Moving…

Between 2019 and 2024, a monumental financial transformation has quietly unfolded within the U.S. life insurance sector: approximately $800 billion in reserves have been shifted offshore. This staggering figure not only marks one of the largest capital reallocations in recent industry history but also signals a significant evolution in how insurers manage risk, capital, and … Read more

Between 2019 and 2024, a monumental financial transformation has quietly unfolded within the U.S. life insurance sector: approximately $800 billion in reserves have been shifted offshore. This staggering figure not only marks one of the largest capital reallocations in recent industry history but also signals a significant evolution in how insurers manage risk, capital, and … Read more

Just Dropped

Items to Stop Buying to Save…

(This page may contain affiliate links and we may earn fees from qualifying purchases at no additional cost to you. See our Disclosure for more info.) We live in a world filled with alluring advertisements and seemingly indispensable products. So, it’s no wonder we sometimes buy things we don’t need and regret it later.

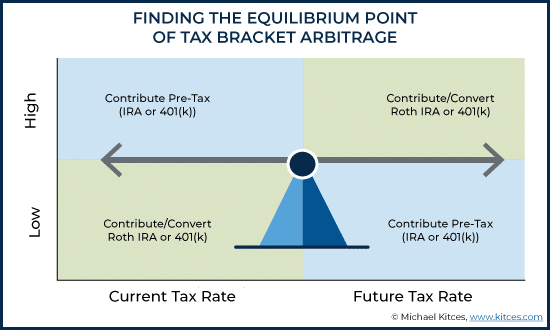

0% Capital Gains vs. Roth Conversions:…

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Today’s question is the kind that might make you think, “That’s too complicated,” or “Surely that doesn’t apply to me.” That’s ok. If you prefer to keep things simple, knowing that you’re leaving tax dollars lying around on the

#625: JL Collins Part 2: What…

What do you do when you’ve reached financial independence? JL Collins says it depends entirely on your spending rate, not just your net worth. Collins joins us for part two of our conversation about what happens after you reach financial independence. He tackles the question of whether you should invest differently once you’ve “won the

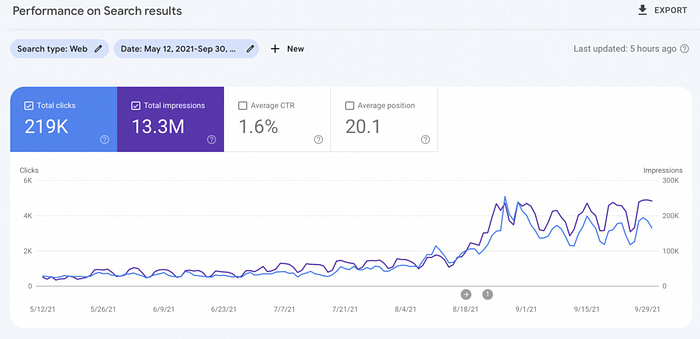

An update on our newest media…

This article is a continuation of our initial story on launching FinMasters and spending $477,924 to do so, make sure you read that one first for context. Here’s an overview of what I intend to discuss: An update on what we did for the past 18 months Google & publishers What went wrong? If anything?

Prop Firms That Use TradingView –…

TradingView is an invaluable tool for traders of all levels, providing cutting-edge charting and analytical resources. The platform has made a significant impact on the trading community, and many proprietary (prop) trading firms have adopted it as a key part of their trading infrastructure. This article will delve into the features that make TradingView popular

Best Self-Employed Jobs for Canadians in…

Thousands of Canadians dream of being their own boss, having the flexibility to choose when they work, and being able to control their income. Self-employment can be a rewarding and fulfilling alternative to traditional employment, but you need to find the right kind of job. For example, you can’t become a self-employed banker or high

You don’t have to be afraid…

Advertiser Disclosure: rich & REGULAR is a member of affiliate marketing programs and may receive commission in exchange for promoting products and services. I [Julien] hate hotel gift shops. Every time I set foot in one, I can feel the insane price premium squeezing money out of me. One time, while visiting Florida, I’d completely forgotten to

How I Became a Project Manager…

For the past decade, I’ve been running this blog. My passion for blogging faded a long time ago, but I kept at it because it was still bringing in income. As the years went on, I got really fed up with the ups and downs of blogging. Social media was always changing, and the nonstop

![Discretionary trusts: cautious optimism [Members]](https://mysmartfinance.one/wp-content/uploads/2025/07/Moguls-Main.jpg)

Discretionary trusts: cautious optimism [Members]

For MOGULS by Finumus on July 17, 2025 When I first began researching discretionary trusts, I expected to hate them. Now I’m not so sure. They might just be the least-bad tool we’ve got for a certain high-class problem. Yes, I’m talking again about inheritance tax (IHT). This article can be read by selected Monevator

10 Things To Stop Buying If…

Have you ever looked at your bank account and asked yourself, “Where did all my money go?” You’re not alone. Even with the best intentions, it’s easy to fall into spending patterns that quietly chip away at your budget, and hold you back from your financial goals. But here’s the good news: it’s not about